AI in the Enterprise: Priorities, Pressures and Pragmatism

CCS Insight’s Survey: Senior Leadership IT Investment captures the views of IT and business executives, offering a snapshot of enterprise technology priorities. Our 2025 results show a shift toward pragmatism, with leaders committing to secure execution, AI adoption and infrastructure readiness as they navigate skill shortages and budget pressures.

AI is the hot topic in the industry, transforming enterprises of all sizes. This article highlights our top findings about investment in AI, revealing the rate of deployment, spending priorities and concerns with the technology. For more insights, sign up for our free webinar at 4 PM (BST) on Thursday 5 June.

Enterprise appetite for generative AI is striking: 38% of organizations have deployments under way, and a further 44% plan to follow within the next 12 months. That means more than four in five expect to have generative AI in production by mid-2026, signalling a decisive shift from experimentation to expectation.

The focus is operational, not speculative. Respondents told us that productivity, IT automation and workflow automation are the areas most affected by generative AI, a signal that the technology is being treated as a lever for speed, scale and internal efficiency. Notably, return on investment trails lower in the rankings. This suggests that although organizations are seeing operational benefits, measurable financial returns are still emerging, reflecting the early stage of adoption.

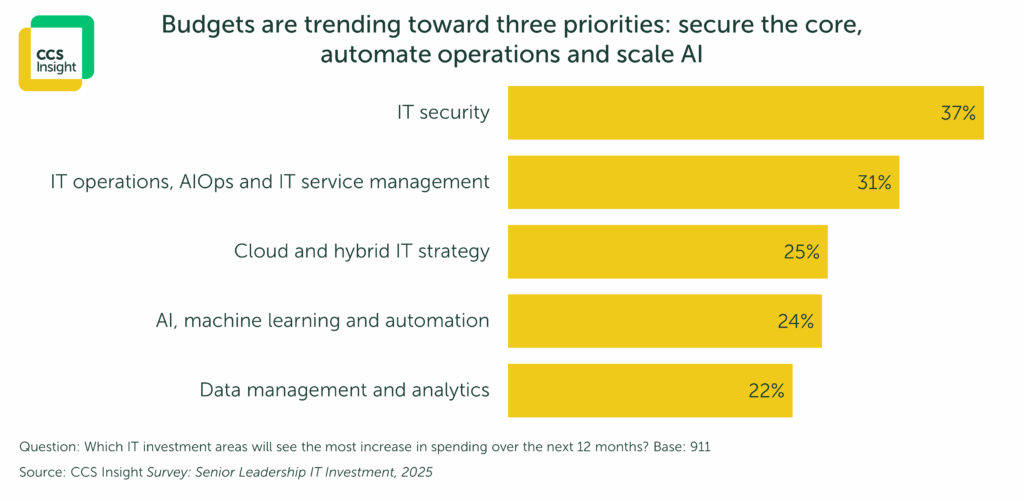

Spending intentions back up this ambition to increase deployment. AI and automation feature in the top five areas for budget increases, up from seventh place in last year’s survey. Also, AI-driven network management is now the second-most-cited priority for infrastructure teams.

However, adoption isn’t without friction. Security and privacy are a top concern, even though two-thirds of respondents say their company already has the right AI governance frameworks in place. This gap suggests policy may be outpacing practical controls.

The full 2025 survey covers very small businesses to global enterprises in the US, the UK, France, Germany, Spain, Sweden, Italy and the Netherlands across a range of roles and industries. The findings highlight clear opportunities for technology suppliers, ecosystem partners and channel marketplaces looking to align their offerings with enterprise priorities. Across AI enablement, infrastructure modernization and skills-driven services, the data reveals where enterprises are directing their IT spending.

For more survey insights and data, sign up for our webinar, Recalibrating IT Investment Priorities: A Guide for 2025 and Beyond, on Thursday 5 June, 4 PM (BST). Registrants will also receive a recording of the webinar.

LinkedIn

LinkedIn

Email

Email

Facebook

Facebook

X

X