UK Operators’ Main Brands Face Years of Subscriber Losses

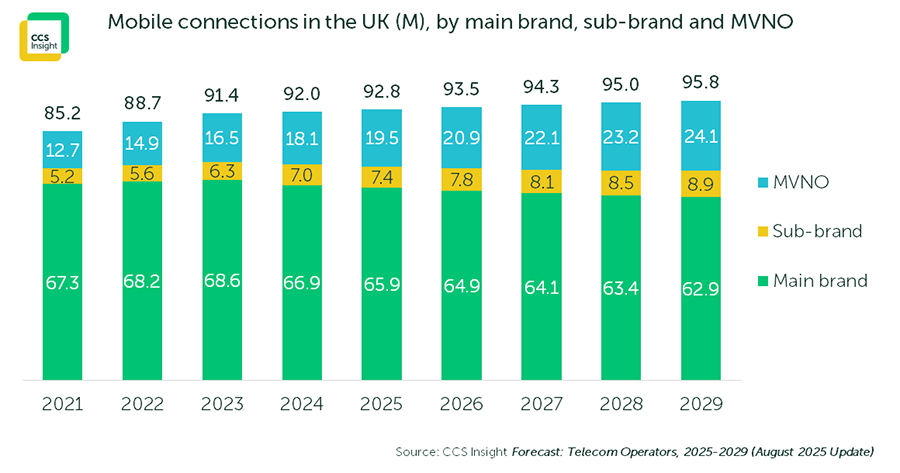

CCS Insight’s latest operator forecast shows that the UK’s three major network operators will lose connections to their main brands every year from 2025 to 2029. Main brands refers to EE, O2, Three and Vodafone. Changes in consumer behaviour have created clear openings for mobile virtual network operators (MVNOs), and some have taken full advantage. Operators have responded by investing in their sub-brands, going head to head with MVNOs.

This decline began in 2024, when the main brands’ mobile connections fell by 2.5%. Three main factors are behind this shift.

Firstly, the pandemic and cost-of-living crisis between 2020 and 2023 pushed people to cheaper, no-frills plans from MVNOs, which allow them to use the same network and get a similar monthly data allowance at lower prices.

Secondly, the mobile phone market has been struggling, with fewer consumers buying a new phone each year. As a result, operators are getting less revenue from contracts sold through main brands, which operators use to offer their most attractive phone deal. In addition, sales through operator stores have declined, reducing customer touch points that used to help secure long-term contracts. And with growing adoption of eSIM, operators will lose another point of interaction, making it harder to show their value and expertise and leaving price as the main battleground — one that MVNOs are likely to win.

Thirdly, many people have taken SIM-only offerings as they rein in spending and move onto deals after the end of their contracts. Retailers like Argos, John Lewis and refurbished providers have also encouraged SIM-free sales. One-month SIM-only contracts in particular are having a big impact: in our annual survey of mobile buying behaviour, 43% of SIM-only users were on a 30-day contract. As a result, switching providers is easier than ever, weakening brand loyalty.

Three of the four operator brands have used their sub-brands to respond, with giffgaff, Voxi and Smarty leading the way by offering low-priced deals focused on data. giffgaff has attempted to capitalize on the rise of the second-hand market, offering lower-price contracts with refurbished devices.

EE is the one outlier without a sub-brand, having closed its Plusnet mobile service. As we discussed in this blog, EE has always positioned on quality of service; former boss Marc Allera used to regularly declare that his customers “could buy cheaper, but never better”. However, against a tough economic backdrop, this message has become harder to land.

MVNOs themselves have also done a very good job of launching alternatives to existing market offers, addressing customer frustrations by not charging for roaming, rejecting annual contract rises, offering data rollover and better aligning with a parent brand. Operators have attempted to match some of these moves, like O2 providing data rollovers to its premium plans.

MVNOs currently hold 20% of the market, and we expect this to grow to 25% by 2029. This will be driven by both existing players and new entrants such as Revolut. Sub-brands are also making gains, and by 2029, connections are expected to reach close to 9 million (see chart below), but this excludes the possible launch of a BT/EE sub-brand, with the operator increasingly vulnerable at the lower end of the market. However, VodafoneThree may have sought to consolidate its Voxi and Smarty sub-brands by this date.

One factor that could slow the momentum of MVNOs is that with the UK market only having three main operators, they may be less motivated to offer competitive wholesale terms. This could happen after the end of VodafoneThree’s wholesale reference offer agreement in 2028, with a potential increase in wholesale prices curtailing the MVNOs’ ability to compete so heavily on price.

Although sub-brands have softened the blow for operators, they create a different challenge in lowering average revenue per customer with cheaper deals.

Operators need to raise the value of the main brands to help maintain revenue levels, but this won’t be easy to do as customers cut spending on mobile plans. There are several possible ways to do this.

The most significant opportunity is convergence, a topic discussed at length in our recent report. Despite BT’s acquisition of EE and the Virgin Media–O2 merger, the UK market has struggled to take full advantage of the potential of convergence. However, EE has made strong progress, with the share of households taking a converged service exceeding 25% in its most recent quarter. We also expect the recently merged VodafoneThree to push heavily into this area, creating a competitive market that encourages households to choose combined mobile and fixed-line packages.

This strategy could significantly increase revenue and reduce the likelihood of customers leaving, therefore lowering churn and making it more expensive for MVNOs to acquire mobile customers. MVNOs and “altnets” could partner to offer their own converged service offerings, but we believe this impact will be minimal.

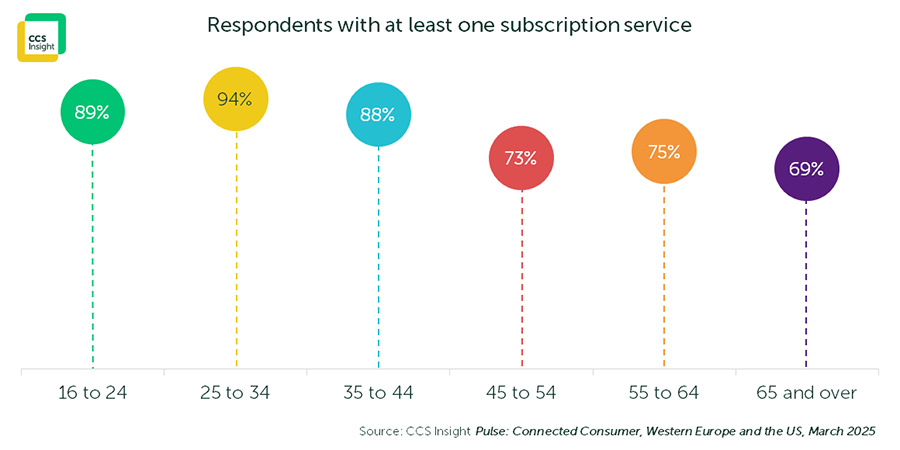

Another area of focus is bundling. Data from our Pulse: Connected Consumer, UK, March 2025 reveals that 94% of 25- to 34-year-olds have at least one subscription, often several (see chart below). This could include TV, music, fitness, gaming or cloud storage. Consumers increasingly want to simplify the process of taking out subscription packages by combining them into one bill. Operators are looking to take advantage of this by partnering with companies like Bango, which provides an API that makes it easier to offer bundled TV streaming services or fitness apps that require subscriptions.

One area that has yet to reach the UK market will present an interesting decision for operators: satellite technology. For now, it’s limited to emergency messaging and basic SMS texting, but future features could be sold as premium add-ons for main brands and serve as a point of differentiation from sub-brands and MVNOs, depending on their contractual agreements with their wholesale partners.

These strategies should help operators’ main brands make up for lost revenue from declining mobile connections and offer points of differentiation that smaller MVNOs may struggle to replicate.

But with SIM-only deals becoming standard and the second-hand phone market performing well, consumers have become used to spending proportionally less on telecom services — can operators reverse this trend and convince them to pay more? If they increase the value they offer, particularly through converged and bundled services, there’s a good chance they can.

LinkedIn

LinkedIn

Email

Email

Facebook

Facebook

X

X