The Slow Decline of Traditional Telecom Retail

Telecom retailing has remained impressively resilient amid the seemingly terminal demise of Britain’s high streets. Carphone Warehouse in 2020 and Phones 4U in 2014 have been the main victims of a long-term trend of slowing device sales and growth of online channels. Yet, CCS Insight estimates that EE, Vodafone, Three and O2 still operate over 1,400 shops. Furthermore, our consumer research consistently shows that about one-third of people have visited at least one mobile phone shop in the previous six months.

A few times a year, I like to do some mystery shopping with each provider to gain a sense of how they’re engaging with customers. You can read musings of some of my previous trips here and here. This time, I ventured to Croydon to survey the landscape.

Overall, it was an uninspiring trip that raised numerous questions as to whether bricks-and-mortar retail has a long-term role in the telecom sector. More on that later, but first, a few thoughts on which areas the operators are focusing on.

My first stop was EE, where I was immediately struck by the prominence of broadband and TV, which felt at least on a par with mobile. This included a large promotion of Sky Stream, which has been part of the EE TV offering since late 2024.

It was hard to miss the many references to Wi-Fi 7, a technology that underpins EE’s broadband and TV offers. I’ve long been sceptical about using technology terms in marketing, and in our survey last December, less than one-fifth of people (19%) said they knew what Wi-Fi 7 is. Physical stores offer an opening to explain in person, but I didn’t see any evidence of this, which felt like a missed opportunity.

I had to look very closely to find anything related to EE One, a programme offering discounts to people taking broadband and pay-monthly mobile. Converged services are a leading pillar for EE, so it was odd that it was so under the radar, particularly given the space afforded to non-mobile services.

I was pleased to see promotions for EE’s admirable efforts to address concerns about online safety. This includes the recent launch of a series of phone plans for under-18s and support tools for families. I also spotted screens showcasing EE’s Game Mode and Work Mode offers, which allow customers to customize their connection depending on how they use it.

My visit offered little clarity on BT’s consumer branding strategy, which I understand is under review. Outside the store, the BT and EE logos were almost equally prominent. But inside, everything was EE. The company is reportedly considering slowing the transition from BT to EE in the consumer market because older customers have a greater attachment to the BT brand.

At O2, I observed a greater emphasis on promoting Virgin Media’s broadband and TV products than on my last visit. This included content aggregation service, Stream; bundled broadband and mobile offer, Volt; and various set-top boxes and remote controls.

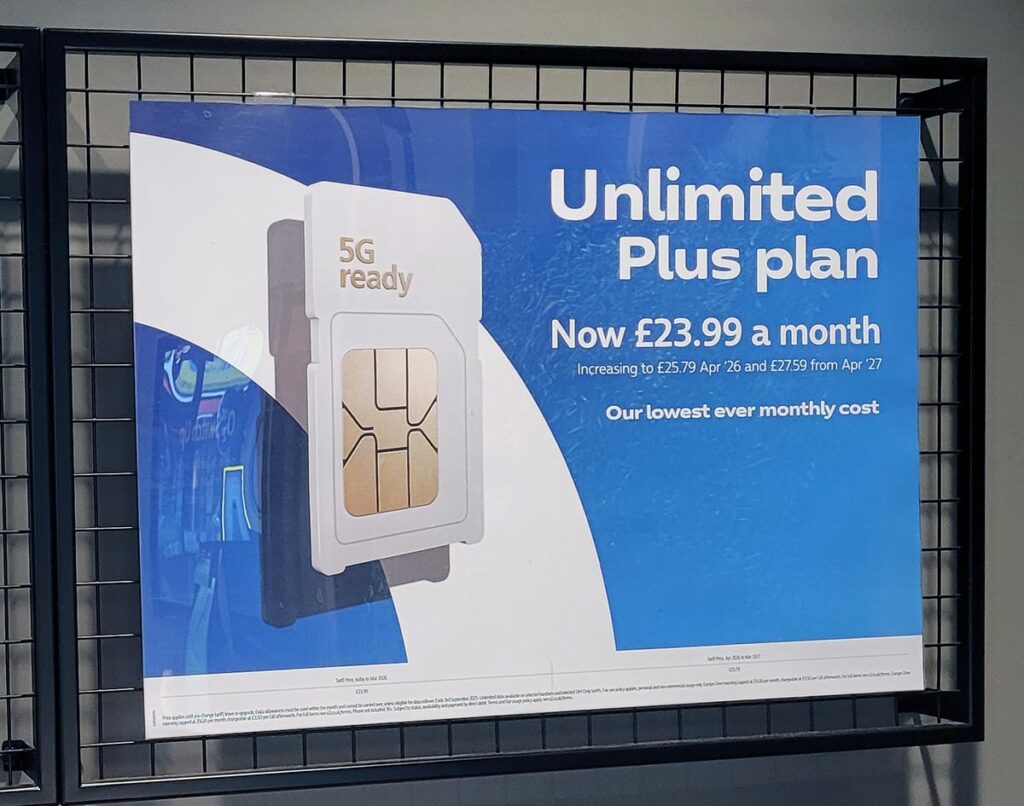

On the mobile side, a big display showcasing an unlimited 5G SIM plan, priced at £23.99 a month, caught my eye. Our research reveals pent-up demand for the all-you-can-eat option, although I’m dubious whether people really need it. A quick web search shows that O2 also offers a 100 GB plan for £19.99, which feels like a better deal for most people.

I also spotted an advert for inclusive EU roaming, an important differentiator for O2, and a small placard informing of the pending closure of the 3G network — O2 is the last UK operator to make this move.

At Vodafone, the largest of the four stores, I noted several promotions under a “back to school” banner. Bizarrely, these included premium smartphones like the Samsung Galaxy S25 Ultra, which costs upward of £54 per month — hardly an obvious choice for school-age children, in my opinion.

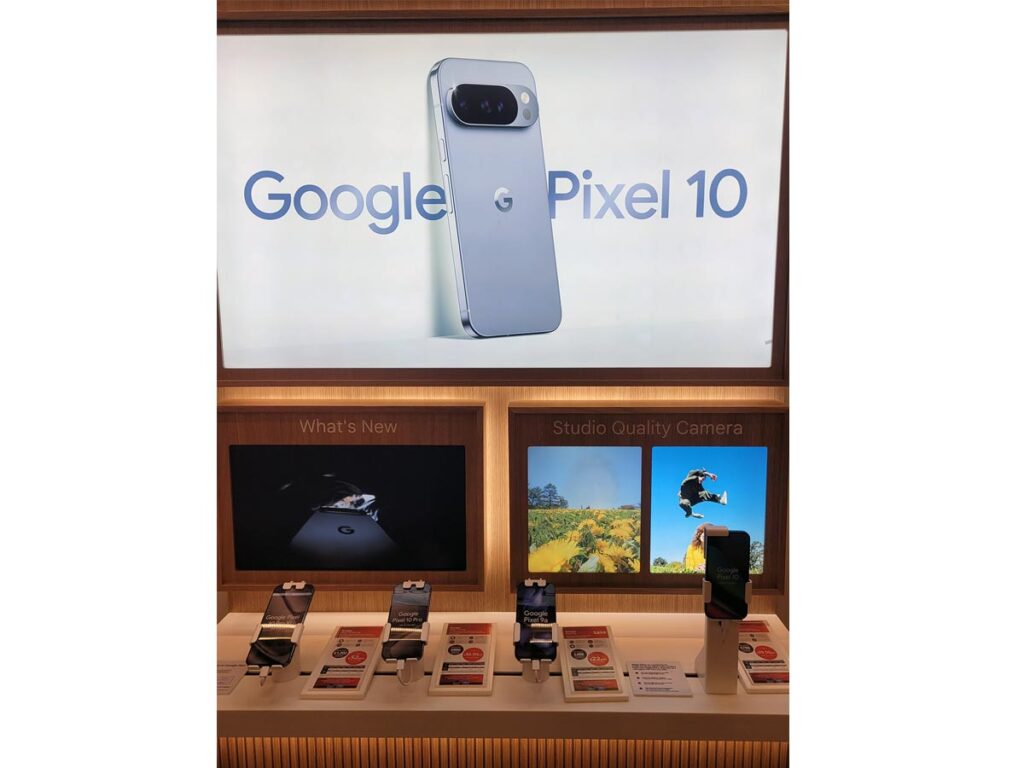

As in all stores, Vodafone is strongly promoting the new Google Pixel 10 range of smartphones, which was announced a few days earlier. Pixel offers a welcome alternative to Apple and Samsung phones, which dominate the market. However, I suspect the latest iPhone, which will be announced today, will soon take centre stage once again.

The only other phone brand with a meaningful presence was Honor, probably thanks to the company’s significant marketing spending. This included its latest foldable, the impressively thin Magic V5. However, getting hands-on with foldable smartphones was a frustrating experience, with security clamping preventing me from gaining any meaningful interaction. This is part of a wider challenge of retailing foldables discussed by my colleague Ben Wood in this article.

Vodafone had a large display to promote its home broadband offer, which it continues to market strongly. It’s gaining rewards too, consistently reporting strong net additions in an otherwise flat market.

Six doors down sits Vodafone’s sibling, Three. There was no evidence in either store that the companies are now part of the same family. I wasn’t surprised by this; although the joint venture has been keen to talk up the faster speeds that Three customers are apparently already enjoying, its strategy is to keep the brands separate for now.

However, Max Taylor, CEO of VodafoneThree, has already confirmed that some stores will close, and I reckon this scrappy outlet would probably be a firm contender to face the chop. Admittedly, it’s a small space, but there was little to entice customers through the doors, and the staff seemed disinterested. The main messages were the same as on my recent mystery shopping trips: home broadband, Three Business, the Three+ rewards app, a partnership with Paramount and Ookla’s accolade of “the UK’s fastest 5G network”.

Alarmingly, when I queried the lack of iPhones on display under the Apple banner, I was told it was because of theft. This probably explains the large number of dummy models I saw throughout my trip. These make it almost impossible to get a sense of what a new device feels like, undermining the main reason to visit a store to choose a phone in the first place.

Since my visit, I was interested to read that some UK stores are deploying new security measures in response to a rise in phone theft. These include security guards to open the doors during trading hours, and the potential use of a “kill switch” to disable stolen devices.

I’m loath to admit it, but the trip made a very poor case as to why operators would want to maintain a high-street presence. Physical retailing is an expensive investment as the industry seeks to cut costs. All four shops I visited had more staff than customers, and I found very little that couldn’t be bought or researched online.

It concerns me about the future. I’ve always argued that face-to-face conversations are the most worthwhile, but you could say the same about banking, which is moving online at breakneck speed.

That’s not to say that shops can’t still play a role, and I’m a big admirer of the experience stores EE has been launching up and down the country. But in the traditional guise, it’s hard to see anything other than continued declines for physical retail.

LinkedIn

LinkedIn

Email

Email

Facebook

Facebook

X

X